The global uncertainties immobilized the economic growth around the world and emerging economies were not left behind. India economy too stalled in the second half of year 2011 caused by cumbersome inflation and rising policy rates. Lots of constraint is on the way of the Indian economy.

Shortlink for this Research: unidow.com/1210 | Get it in .pdf

Alongside the assembly elections in five Indian states, the unequivocal major economic indicators are the important source of conviction for the economy this year. Unlike last year, the economic growth is expected to be above the potential economic growth and the falling inflation should be given a credit for the same. Asia’s third largest economy was on the backburner due to higher interest rates and inflation last year, fallen down to below 6 per cent of annual expansion. India’s home grown problem rooted from the corruption charges against the federal government and paucity of important economic reforms, which was expected during last year, push the Indian economy on the downside. In our last economic outlook report, we emphasized that RBI will not even think about the economic growth prospect since inflation was the major quagmire for the central bank and has left with no room for further inclination on the price rise. Central bank’s primary job is to have stable prices in an economy with stable job prospect. However, only the stable economy would ensure the good job prospect and RBI at this point does fail to act on just because to bring down the inflation under control. Nowadays, the Indian Rupee is in the global headlines as the “worst performing currency in Asia by falling more than 20% against the US Dollar”. Indian Rupee (INR) is one the most risky and volatile currency in the world with managed float system. RBI intervenes when the currency’s fall is wild and threatens the economic prospect like it does last year. Below is the balance of India’s international trade.

Rupee’s Fall – How fatal could it be?

What makes rupee a black beat? India’s home grown problem widens the parity between major currencies. The Indian currency is on the down-fall and depreciated against USD last year by more than 20 per cent. Reasons could be anything but the ultra reason is the government’s inaction for the economy. Major economic reforms remained unclear and stalled in the legislative assembly which depressed the investment prospect in the country. This fiscal (FY2012) till Nov 2011, India received about $1.01 billion in foreign portfolio investments or popularly known as FIIs – in compare to $31 billion in fiscal 2011. The one interesting findings of our research is that, India remains a favorite destination for the long-term investments and its position of being an investors’ darling remains intact. The foreign direct investment into the country is somewhat sluggish but remained buoyant. So far, in this fiscal, India attracted FDI of nearly $33 billion, which is comparatively larger than FY11. Apparently, the currency has lost its value by 20 per cent. However, it is not necessary that rupee’s depreciation can only have an adverse effect. We understand that India does not have a positive trade balance and the trade gap could largely get affected by depreciation of the quote currency (INR). However, most importantly, on the fiscal side, despite the rupee’s fall, India can subsist with the expensive US Dollar. From the latest figures related to the Indian government’s external borrowings, India owes a very little amount of total debt quoted in foreign currency (about nine per cent of total public debt, see the provided table) and the expensive USD could not significantly affect the interest payments of the government on an annual basis since it accounts for 20% of government’s expenditure – means the general budget will not get imbalanced and will be focused on the fiscal consolidation. Perhaps, the local currency depreciation seems to have lesser impact on the fiscal side and will not be subsided during the crucial budget session, when India’s Finance Minister Mr. Mukherjee presents the general budget.

| Indian Government Borrowings | ||||

| Public Debt | Upto Sep 11 | Upto Jun 11 | % of Total Debt | |

| Internal Debt | 2935618 | 2816693 | 76.06% | |

| External Debt | 340750 | 312280 | 8.83% | |

The considerable point is, rupee’s fall could be a can of worm for the Indian companies, since they borrow money from low-cost capital supplying countries like Japan, the United States, the United Kingdom and the Euro zone to meet their funding requirements for working capital, project expansion and capital expenditures. As per latest data, the Indian companies’ net outstanding of offshore commercial borrowings is almost 30 per cent of the total external debt, up from 27 per cent in 2010, facing the biggest currency translation risk due to currency’s movement. This lion share of external debt could even rise further due to valuation effect. On the other side, trade deficit will become a cumbersome since India’s biggest supplier is Saudi Arabia, which exports $20 billion worth of crude oil annually and rise in USD will make imports expensive. However, what about the exports or consumers of the Indian product? One side, we understand that the imports are getting expensive and widens the trade deficit, but on the other side, exports will become cheaper for the Indian suppliers too. So, where’s the problem? India’s exports are not a bottom-rung which does not attract any buyers. We have provided the international trade results which show a narrow gap in second half of last fiscal year. Trade gap was fallen down to $2.6 billion in Dec 2010, it is indeed the trade gap widened to $20 billion in this fiscal largely due to higher oil imports, but this is a temporary movement. Subsequently, the richness of export’s value could offset the import’s losses.

Inflation Prospect

It’s evident that the price levels are significantly decreasing to the lowest levels in two years and peaked around 10% in Sep, 2011 which we have projected a year ago. Primary articles including the food and non-food articles grew by 3.04% in Dec 2011 but the important indicator for the central bank while taking monetary action, “Manufacturing” index is still unstable enough to hinder any policy action on the down-side. Prices in the month of Dec, 2011 increased by 7.47%, lowest in 24 months. Due to the new base effect, it is certain that inflation could even fall to 5% in the next 2-3 months, below the RBI’s comfortable levels. However, does it lead RBI to think about interest rate cut? Any policy action at this point will cause prices to exaggerate as the price indicator does not show the stability and largely abated due to base effect. Even, the RBI wouldn’t be in a hurry to take policy action to stimulate the economy and under the current bleak economic circumstances on the basis of current inflation figures.

The core problem of the headline inflation is the rise in non-food articles and food prices remained subtle at higher prices but the growth with the corresponding year was not as high as the growth of the manufacturing sector. It’s quite clear that the RBI’s policy rates will not come down to the levels of 2008 until the adequate price stability.

India Economy: What’s Next? Medium-term is Bright But Sustainable Long-term Growth Seems Hundred-to-one!

With a dismal performance, India’s home grown problem is enough to dent its economic growth, so it does last year. From 9.1 percent of annual economic expansion to 7.5 percent is an evident that the economic growth bulldozed in the second half last year. From the internal problems to the external, the broader economy faces a downward pressure. Inflation caused the major problems in the economy starting from higher borrowing cost. India’s central bank,RBI revised interest rates in its each monthly review meeting, which pushed the Indian companies to go abroad for raising funds. Per the current statistics of VMW Analytic, Indian companies’ borrowing through the external commercial borrowing route for fiscal 2012 is at $99 billion, increasing the overall external debt burden to $326 billion. Here, the sore point is the rupee’s depreciation. Although, the government’s external debt is around $27 billion out of $721 billion of total public debt. The Indian currency is one of the considerable remora in the current scenario. Like we discussed the flip side of the rupee’s fall, its performance on the broader perspective is a confrontation for the Indian corporate. India, as of now, is not a suitable country to have its currency undervalued or expensive against the US Dollar as the country’s infrastructure bottleneck is a barrier to growth. Everything is tied-up to this problem. Even the prices have been a stubborn due to supply chain constraint and technological barriers, giving the Indian economy a challenge with a small room to grow at 9 percent.

If we look at the foreign reserves asset of the central bank, there is a consistent decline due to rupee depreciation. Since the Indian currency is a managed float currency, RBI generally intervenes in the currency market to balance the cross border trade on the either side – so it does taking the same action to tweak the INR/USD relationship. Is it necessary? Apparently, the domestic demand is the biggest driver of the Indian economy and India could not satisfy its demand through its domestic produce. Crude Oil is the biggest single commodity and a best example to demonstrate the domestic demand. Expensive rupee will virtually make the imported products expensive. In this situation, RBI starts purchasing the INR (when rupee depreciates) by selling the USD from its reserve assets to take it back to the comfortable zone of trade. The purpose of highlighting this is to think about the important source of financing the trade deficit. RBI is gradually losing its important asset which could make the situation worse and unbalanced BoP. Perhaps, selling USD to give INR a relief is not a permanent solution. There is a lag in infrastructure commitment by the federal government. The urbanization process is at a slower pace and the existing urban cities do not have abundant financial sources to make a considerable investment for a sustainable growth. With 5 per cent allocation of GDP’s resource to the country’s infrastructure, government would not be able to meet its long term strategy and sustainable economic expansion in the long run will become a challenge. VMW discussed the issues on infrastructure challenges in its next research that will be available soon.

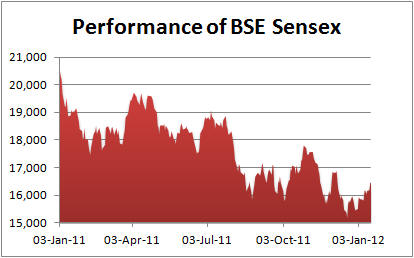

Even, there is a significant decline in the fiscal consolidation efforts by the federal government. Indian legislative assembly stalled because of countless issues, hindering the important bills to be passed in the lower house, pausing the foreign inflows into the country. The pulse of foreign inflows can be measured by looking at the performance of India’s benchmark indices – BSE Sensex, which illustrates the apprehension of foreign investors. In year 2011, India attracted the foreign portfolio investment of $1.01 billion, significantly lower than a year ago.

The first half of the fiscal remains to be volatile until the wind-up of legislative assembly elections. By analyzing the price index, inflationary pressure will be moderate for the next two quarters yet its not likely to remain subtle, pushing the policy makers to proactively work on the fiscal consolidation. In our last research update, we stressed on the inflation side that must be subdued to contain the rising cost of capital. Although, it’s now easing and currently reading close to the RBI’s comfort level. As of now, we’re not expecting anything in surprise from the central bank since prices have not yet stabilized and policy action will have a counter effect on the overall micro side. The other challenging factor, which we have discussed in our Mar 2011 report, that the political uncertainty could deteriorate the investment prospect of the country and so far, the challenges remain same in this year too. Prime Minister Mr. Singh had proposed to introduce the 100% FDI in single brand retail sector to promote the foreign investments and technological advancement in the country to improve supply chain and bring pricing stability, but that too ended without action. The recent Supreme Court’s judgment in Vodafone’s tax case will likely to have a positive impact to boost long-term investment and additionally, it gives a clarity on India’s tax regime.